Known unknowns: How to accommodate uncertainty in energy flexibility

Have you heard of “local flexibility markets” for energy? It’s a pretty interesting idea.

Traditionally, the direction of energy markets was pretty straightforward: power plants generated energy and sold it to users (whether businesses or households), so demand naturally came from consumers, and producers were supposed to adapt to such demand. But the increasing reliance on renewable energy sources has complicated things. Solar and wind power production are hard to predict, relying as they do on highly changeable weather conditions. The quantity of generation is also determined purely from one side – what the weather makes possible – and not in response to demand. So as renewables make up an ever greater share of the power supply, somehow, consumption must be made to adapt to production.

The classical way to influence consumers is through price signals. That can be called an indirect way of adapting demand: raise the price and hope consumers will respond by using less electricity. Off-peak tariffs are a well-established mechanism to shift energy usage to times of lower demand, which works well enough. Household energy users do tend to adapt their behaviour in order to pay the lowest price. For instance, to take advantage of cheaper tariffs more people will do their laundry in the evenings or on weekends, rather than during working hours, which effectively offsets heavy day-time power usage by offices and factories.

But a grid that relies increasingly on more volatile power sources must also find ways to increase flexibility of consumption; not just by shifting it to a different, but set time, but by encouraging more short-term adaptability. We can’t assume a steady supply at any time, so pricing that is fixed by the clock isn’t enough to match consumption to production. We need a more direct way of adapting demand, and that is where local flexibility markets come into play.

Flexibility is the new good for sale

In a flexibility market, the product is not necessarily the energy itself; it can be the availability of energy (which may or may not actually be activated). Flexibility can be contributed to the system from either the consumer or producer sides. So energy consumers and energy producers both form the supply side: they are flexible resource owners. Meanwhile, the demand side comprises transmission and distribution system operators (TSO and DSO), which are the single buyers of energy volumes, and can pay either consumers or producers for flexibility.

Markets of course rely on information. Buyers and sellers must declare their resources and needs. So to develop an efficient flexibility market, we need a way to quantify in advance how much flexibility is available. Which is complicated! This is why NCCR Automation researcher Julie Rousseau (PSL, ETH Zurich) is investigating how to calculate potential flexibility, in a world full of uncertainties. The more we know (even about what we don’t know), the better we can adapt.

Consumers can sell flexibility by making use of their energy storage. If a household possesses an electric vehicle, as long as that car is fully charged in the morning, it doesn’t matter when the charger actually runs. The house itself also stores energy: getting a cold house to a comfortable temperature takes a lot of energy at first, but then (assuming good insulation) it will retain that heat for some time. These two devices are also among the most energy-intensive in a household, but heating is particularly complicated.

In a house of a given size and building standard, the amount of energy needed to heat it will depend on both external factors (the weather) and internal. That is, throwing a party will generate its own heat, as will cooking. If the residents go on holiday, the house may need less heating than usual. And so on. So any consumption flexibility that the household wishes to offer will need to account for these varying conditions that may influence the household needs.

The one thing that is easiest to determine is the desired outcome: we can define a comfortable temperature range (say, between 20º and 24º) for the house interior. It’s fair to assume that residents will be willing and able to moderate their energy consumption as long as the temperature stays within this range. Given basic data on the house, we can also estimate how much energy is needed to maintain that comfort level for the next day. That means we can also calculate how much flexibility this household can offer.

But further in the future, more uncertainty comes into play, and it gets a lot harder.

All we know is how much we don’t know

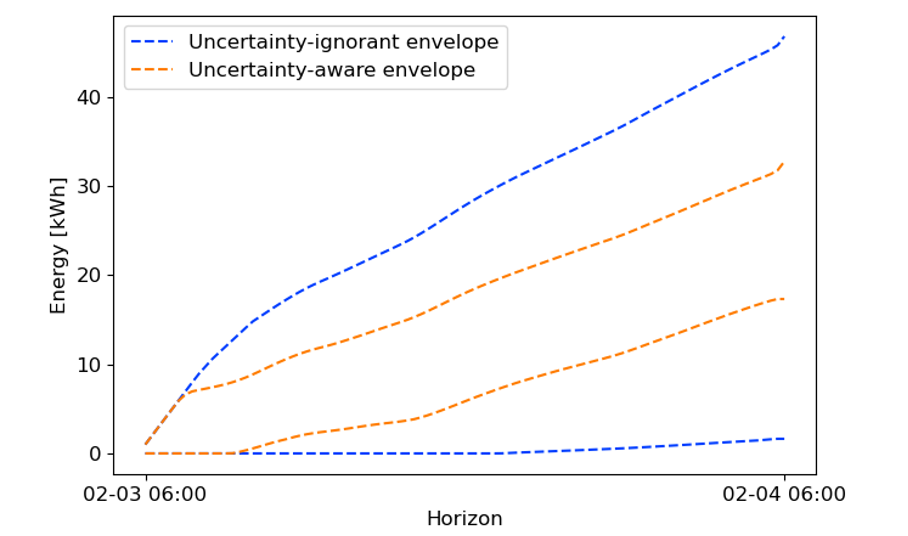

If we calculate future flexibility based on current conditions, the only certainty is that we will make mistakes. The further out the time horizon, the less able we are to make the right calculations, because all those unknown factors add up. The weather forecast for tomorrow is fairly reliable, but still uncertain (especially solar radiation). I may also know my personal plans, but it is reasonable to assume that the model of my building will not. Yet the variability of all those factors will tremendously impact the potential flexibility I can offer.

Our model uses a chance-constrained formulation. Instead of guaranteeing the desired temperature range, that range is assured in only 90% of cases. That still provides for reasonable comfort, but acknowledges the role of uncertainty in real life. It also enables the household to profit from selling flexibility, without sacrificing comfort and safety. It’s a trade-off: the consumer offers less flexibility to the market than if they did not account for uncertainty at all. But instead, they enjoy more security in knowing they will not have to deal with an unexpectedly cold home.

Of course, the flexibility provided by a single household consumer will never compensate for the loss of a single power plant. The more renewable sources contribute to the total power supply, the more important it will be for the flexibility market to develop, aggregating adaptability from many households.

This is why our work is so important. We need better information and better algorithms to calculate the amount of flexibility that can be made available, in order to evolve a functioning marketplace. We can’t reduce most of the uncertainties that affect a household’s energy consumption – but we can plan for them, and feed that data into systems such as smart meters and automated controls, so as to manage the local flexibility market and adapt behaviour.

When applied over a whole community, that can make a major contribution to matching energy consumption to volatile production and so ensuring the resilience of the power grid. We expect that developing efficient local flexibility markets will go a long way to building truly sustainable cities and communities, helping to reduce emissions independently of lifestyle changes.

Written by Robynn Weldon and Julie Rousseau.